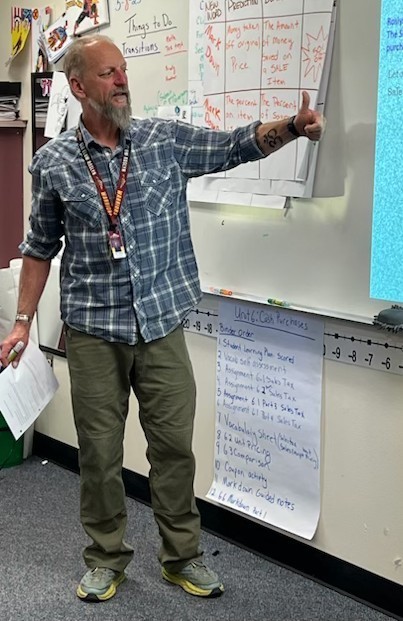

Tax season may be over, but for students in our special education program at Cle Elum-Roslyn, the lessons learned this spring are sure to last a lifetime. Under the guidance of teacher Erik Hanson, students dove into a hands-on financial literacy unit focused on understanding and preparing income taxes.

Tax season may be over, but for students in our special education program at Cle Elum-Roslyn, the lessons learned this spring are sure to last a lifetime. Under the guidance of teacher Erik Hanson, students dove into a hands-on financial literacy unit focused on understanding and preparing income taxes.

Using sample W-2 forms, students completed 1040 income tax returns and explored essential tax-related topics including payroll taxes, federal income taxes, interest income, dependents, filing statuses, and the standard deduction. They also learned how to file both paper and electronic returns.

“This unit really resonated with students because it was a real-life application,” said Hanson. “There were great questions, thoughtful discussions, and lots of engagement throughout. Who knew taxes could actually be fun?”

That engagement paid off—every student passed the final assessment. “Looks like we have some future CPAs in the making,” Hanson added.

This kind of meaningful, real-world learning helps students build skills and confidence that extend far beyond the classroom.